GIVE

ANNUAL GIVING

A donation to our Annual Giving Campaign is encouraged for every family and community member. Contribute today to give our students to a well-rounded education and to maintain the level of excellence they deserve.

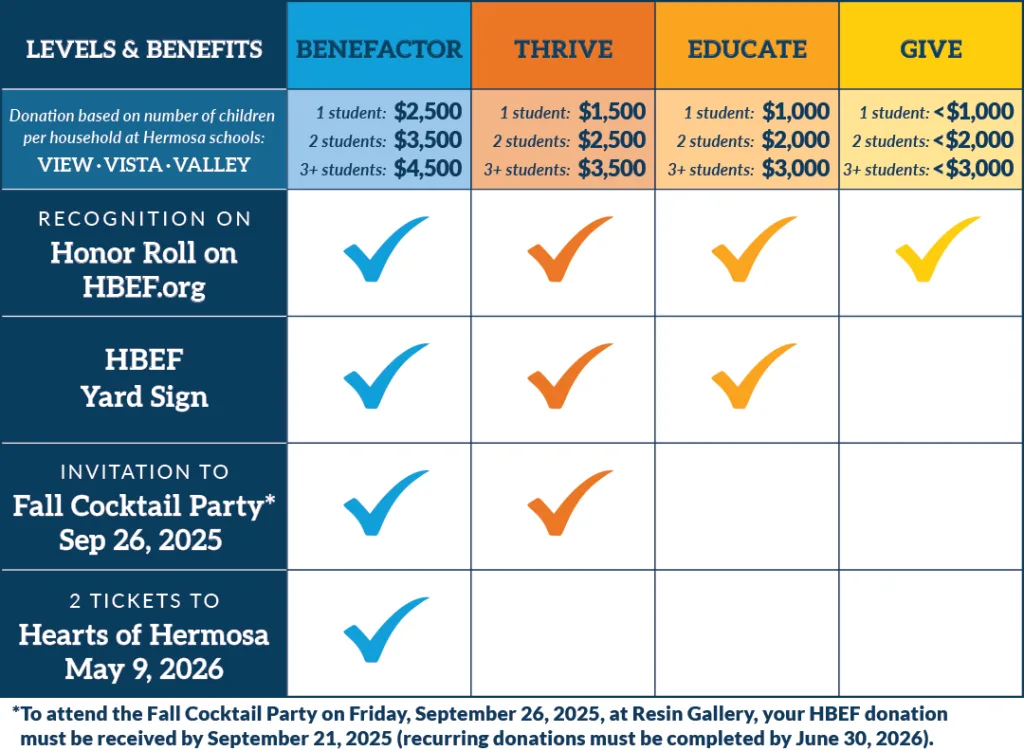

How Much to Give?

We ask each family to consider a gift of at least $1,000 per child currently enrolled in Hermosa schools. However, every gift makes a difference and we ask you to give at the level you are able to.

Thank you for your generosity!

HOW TO DONATE

Give Online

We’ve partnered with Kindful for convenient online payments. (Please note that we also offer other online payment options below.)

Questions? Please reach out to us for assistance.

Become A Monthly Donor

Monthly donations provide a stable source of funds to HBEF while helping you by spreading out your gift over 10 months.

Monthly Donation Calculator:

Donate with Zelle

To send money to HBEF with Zelle, go to your banking app/website and add HBEF as a recipient using the following information:

Hermosa Beach Education Foundation

Account #325156560263

treasurer@hbef.org

Please include the following info in the message:

- Your name as it is to be acknowledged on our Donor Honor Roll? (e.g., “Jane & John Doe” or “Doe Family”)

- Your child/ren & their grade/s

Donate with Venmo

To make a donation to HBEF with Venmo, please use the following link:

Please include the following info in the notes:

- Your name as it is to be acknowledged on our Donor Honor Roll? (e.g., “Jane & John Doe” or “Doe Family”)

- Your child/ren & their grade/s

Donate with Paypal

To make a donation to HBEF with Paypal, please use the following link:

Please include the following info in the notes:

- Your name as it is to be acknowledged on our Donor Honor Roll? (e.g., “Jane & John Doe” or “Doe Family”)

- Your child/ren & their grade/s

Write a Check

Please make the check payable to:

Hermosa Beach Education Foundation

and mail to:

HBEF / Annual Giving

PO Box 864

Hermosa Beach, CA 90254

You may also drop it off at any of our schools’ offices.

Please include the following info in the memo:

- Your name as it is to be acknowledged on our Donor Honor Roll? (e.g., “Jane & John Doe” or “Doe Family”)

- Your child/ren & their grade/s

Donate Stock & Securites

Hermosa Beach Education Foundation Endowment welcomes any contributions, including donations of appreciated marketable securities.

In addition to supporting the Endowment, gifting stocks and securities can have notable tax advantages, including potential tax deductions and exemptions from capital gains taxes. It’s a win/win!

Corporate Matching

Double your impact with corporate matching!

If you know your employer matches but it’s not coming up, please reach out to us for assistance.