FUNDING

FUNDING EDUCATION

Strong schools are essential to Hermosa Beach’s vibrant community. It’s a common misconception that our property taxes fully fund our schools. In reality, state funding doesn’t cover all the costs. That’s why local support is crucial.

Even though school budgets have increased, they’re still not enough for a truly excellent education. This is where HBEF donations make a huge difference. Every donation, big or small, helps fund vital programs and opportunities at View, Vista, and Valley campuses.

HBEF donations are more than just money—they’re our community’s way of investing in our schools, teachers, and students. These funds help us offer diverse programs that prepare our kids for the future.

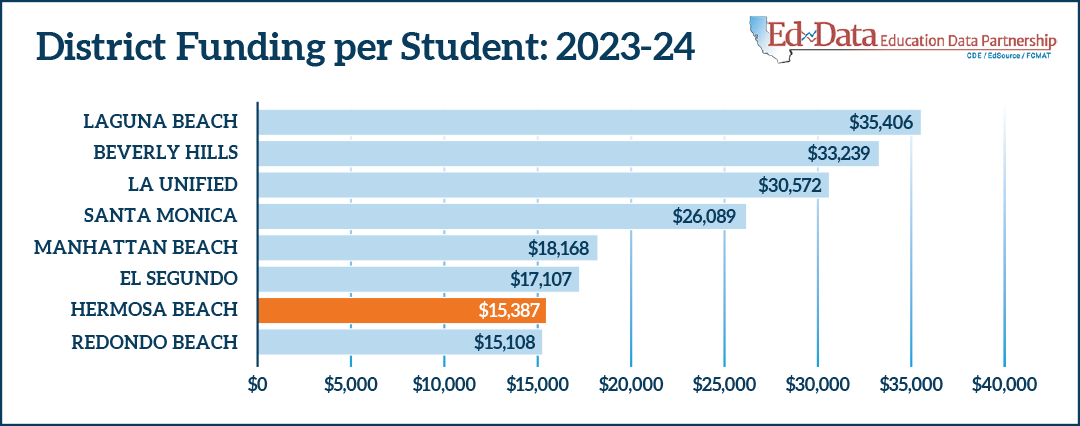

Where does Hermosa Beach fall among its peers in funding?

Hermosa Beach City School District is one of the lower funded districts in California. Our Hermosa Beach schools receive less state funding because the state’s funding formula prioritizes districts with higher concentrations of high-needs students, which Hermosa Beach has relatively few of. While Hermosa Beach has high property values, this does not increase the amount of state funds it receives.

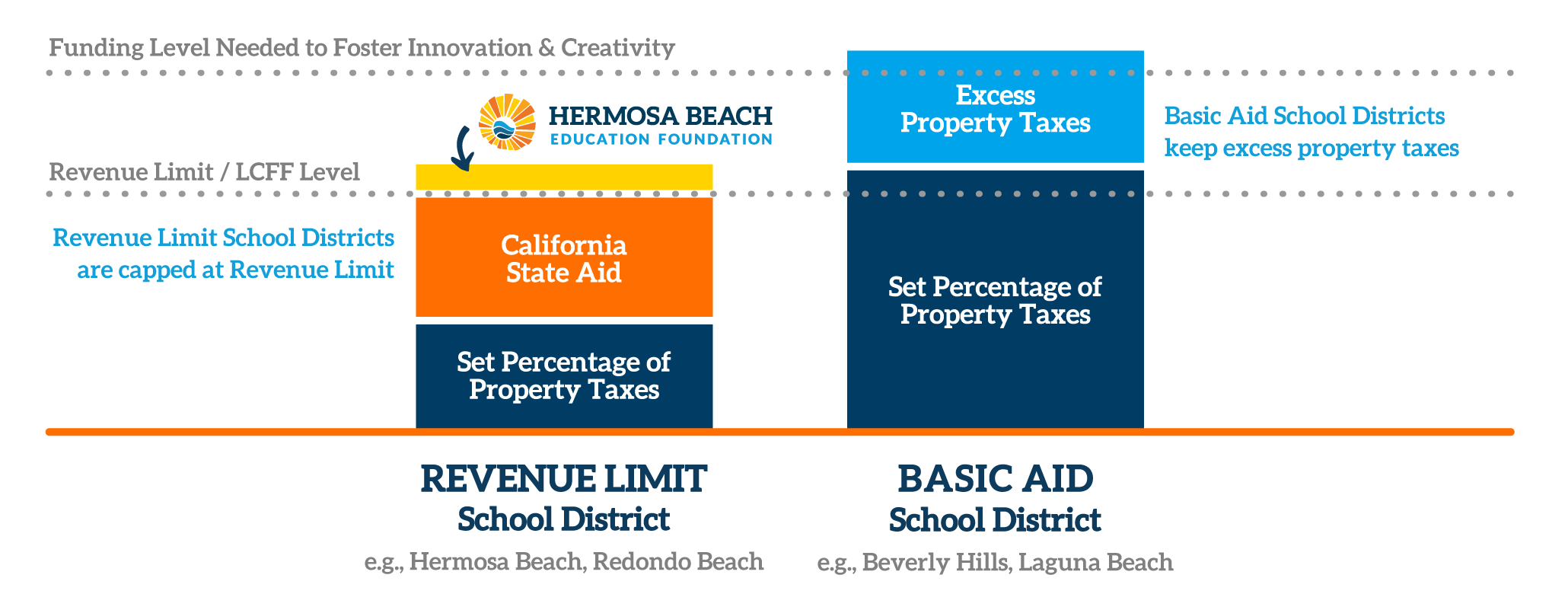

Prop 13: Revenue Limit & Basic Aid School Districts

California’s Proposition 13 dramatically changed how schools are funded. It lowered property taxes, which was good for homeowners, but significantly reduced school funding.

Before 1978: Schools got most of their money from local property taxes.

After 1978: Property tax limits meant less money for schools.

In Hermosa Beach, less than 20% of our city’s property taxes go to our schools. Hermosa Beach City School District, like many others, is a Revenue Limit district, relying heavily on state funding. However, wealthier districts, like Beverly Hills and Laguna Beach, are Basic Aid districts, keeping a larger share of their local tax money for schools.

While Hermosa Beach has relatively high property values, it also has a relatively small student population. Basic Aid status requires that the revenue per student generated from local property taxes exceeds the state’s funding formula. Even with high property values, the revenue per student may not be high enough.

Local Control Funding Formula (LCFF)

As a response to Proposition 13, California had to change how it funds schools. The state started providing more money, leading to a new system called the Local Control Funding Formula (LCFF) in 2013.

LCFF provides a basic amount of money per student. Schools with more students who need extra help (like English learners, low-income students, or foster students) get extra funding. The more students who need help, the more extra funding the school gets. Also, high schools get more money per student than elementary schools.

However, this system creates problems for Hermosa Beach:

- Less Money from Local Taxes: Even though our property taxes are high, we don’t get to keep the extra money for our schools.

- Less State Funding: The LCFF gives more money to schools with more disadvantaged students, which means we get less state funding than we used to.

- Harder to Keep High Standards: We want high-quality education, but the limited funding makes it hard to pay for extra programs and technology.

- Teacher Issues: High living costs and limited funding make it hard to hire and keep good teachers.

The LCFF’s structure and emphasis on equity created unintended disadvantages for neighborhoods like Hermosa Beach.

Help Us Bridge the Gap

Hermosa Students rely on the generosity of our Hermosa Community to bridge the funding gap so that they can compete with others from higher funded school districts.

Give today and be a part of positive change. Your donation to HBEF directly funds innovative programs that shape the future of our students. Every contribution, big or small, empowers our kids and strengthens our community.

Join us in investing in the future of Hermosa Beach—donate today.