FUNDING

FUNDING EDUCATION

Robust public schools constitute a vital component of our thriving and ever-evolving Hermosa Beach community. The notion that our property tax contributions sustain public education is fundamentally inaccurate. Hence, the significance of local assistance to supplement state funding remains essential. While the educational budget has seen growth over time, our public schools continue to operate without the necessary level of funding to deliver a comprehensive education that caters to our students’ diverse needs.

Despite the incremental rise in the budget allocated for education, it falls short of fulfilling the requirements for a truly exceptional educational experience. This is where the importance of donations to HBEF becomes paramount. These donations, whether of small or substantial value, play an integral role in sustaining and enhancing nearly every academic endeavor and enrichment opportunity across View, Vista, and Valley campuses.

The contributions to HBEF extend far beyond mere financial support. They signify a collective commitment from our community to empower our schools, teachers, and students. These funds facilitate the realization of innovative projects, the acquisition of cutting-edge resources, and the implementation of diverse programs that cultivate well-rounded individuals equipped to thrive in an increasingly complex world.

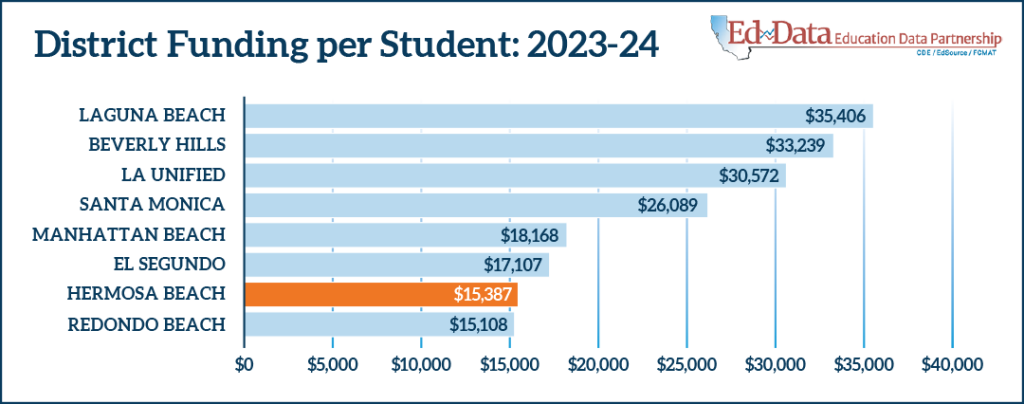

Where does Hermosa Beach fall among its peers in funding?

In 2013, the State of California created a framework called Local Control Funding Formula (LCFF) to allow districts greater control over their individual per district funding allocation.

The LCFF provides a base level of funding per student, also known as a base grant. Beyond that, communities with underserved populations receive up to 20% supplemental funds per student. Higher percentages of certain demographic factors receive concentrated funding beyond the supplemental per-student allocation. Also of note, base grants are larger for grades 9–12 than for lower grades.

Deficit Background

In 1978, California voters approved Proposition 13, a landmark piece of legislation that radically transformed the state’s property tax system. While its primary intention was to limit property tax increases, the far-reaching consequences of Proposition 13 extended to education funding in California.

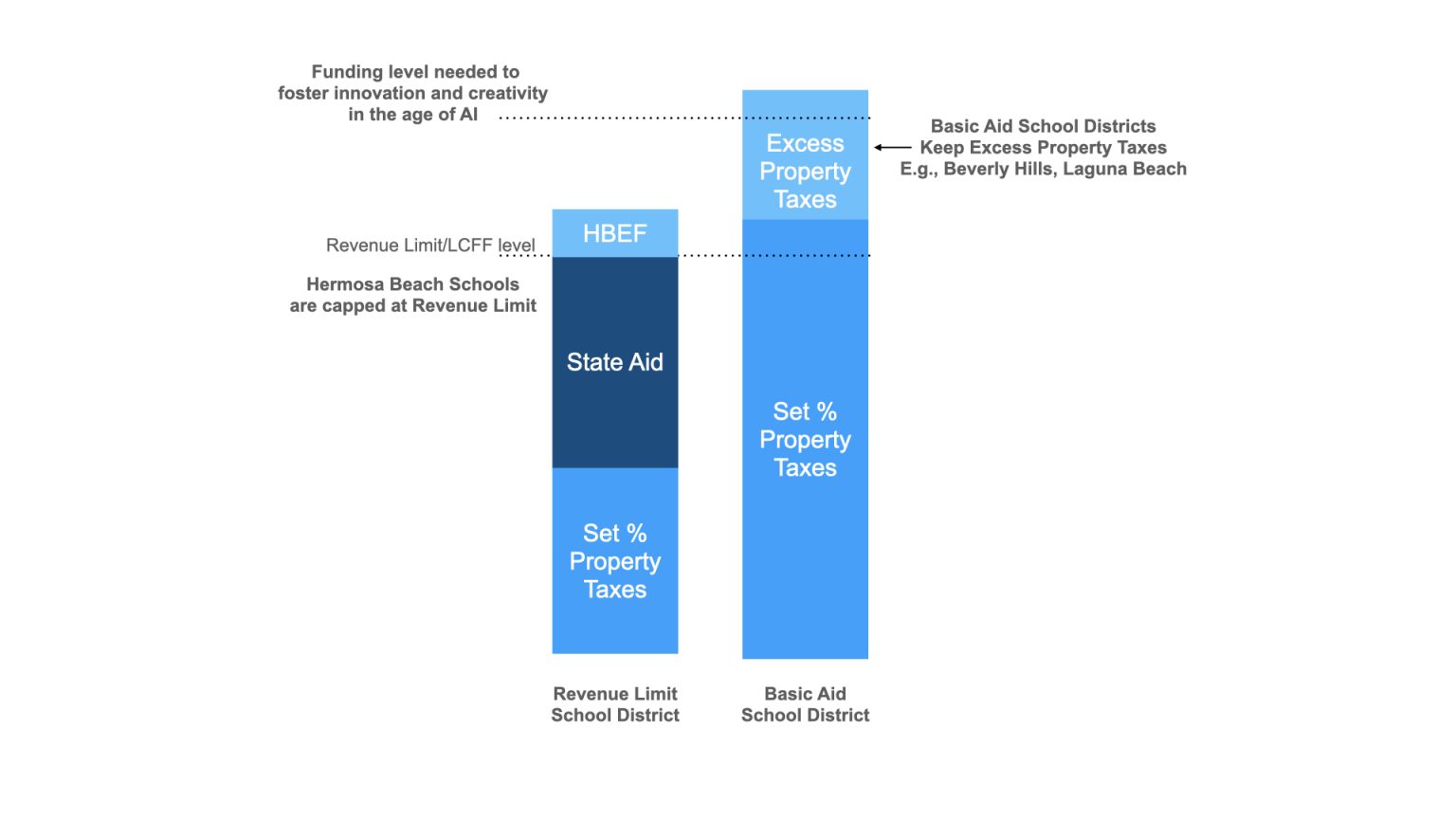

While Proposition 13 provided property tax relief to homeowners, its impact on school districts was immediate and profound. Prior to its passage, local property taxes comprised the majority of revenue for education funding. However, with the implementation of the new tax limitations, school districts faced substantial revenue reductions. As a result, a mere fraction—less than 20%—of the property taxes collected within Hermosa Beach are now directed towards supporting our community’s schools. This classification designates the Hermosa Beach School District (HBCSD) as a Revenue Limit district, which relies heavily on state funding to meet the minimum per pupil funding benchmark set by the state authorities. In contrast, Basic Aid districts like Beverly Hills, Laguna Beach, and Palo Alto, which were financially better positioned at the time Proposition 13 was implemented, enjoy a more substantial share of local tax revenues dedicated to education.

Local Control Funding Formula (LCFF)

- Reduced Funding Relative to Local Property Taxes: In Hermosa Beach, local property tax revenues are high due to the property values. However, because of the way LCFF funds are allocated, our school district does not reap any extra benefits from our high local property taxes.

- Limited State Funding in Comparison: The LCFF’s attempt to level the playing field can result in limited state funding. The formula’s allocation model prioritizes districts with higher percentages of disadvantaged students. While this is intended to uplift underserved communities, it has resulted into a scenario where our school district receive less funding than they would have under previous funding structures.

- Impediments to Maintaining High Standards: Our community has high expectations for educational quality. The LCFF’s limitations can hinder these communities from funding specialized programs, extracurricular activities, advanced technology, and other enhancements that are crucial to meeting their high standards.

- Influence on Attracting and Retaining Teachers: In regions with high living costs, attracting and retaining skilled educators can be a challenge, given potential salary constraints stemming from state funding limitations. This can impact the overall quality of education in Hermosa Beach.